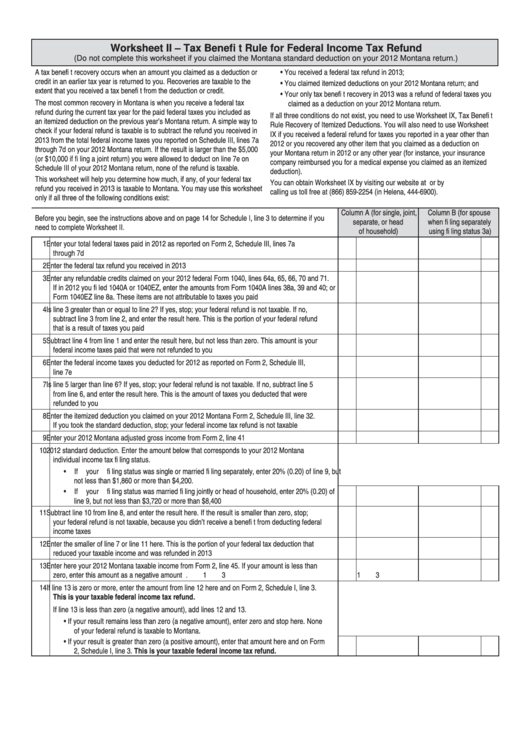

State Tax Refund Worksheet Item Q Line 1 - Do i need to complete the state refund worksheet? I'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Enter amounts from your previous year return and the. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. If you did not itemize. Use this worksheet to determine the taxable portion of your prior year state refund. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return.

Use this worksheet to determine the taxable portion of your prior year state refund. Enter amounts from your previous year return and the. State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. Do i need to complete the state refund worksheet? If you did not itemize. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. I'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for:

I'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Do i need to complete the state refund worksheet? State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. Enter amounts from your previous year return and the. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. Use this worksheet to determine the taxable portion of your prior year state refund. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. If you did not itemize.

State Tax Refund Worksheet Item Q Line 2

State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. I'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Enter amounts.

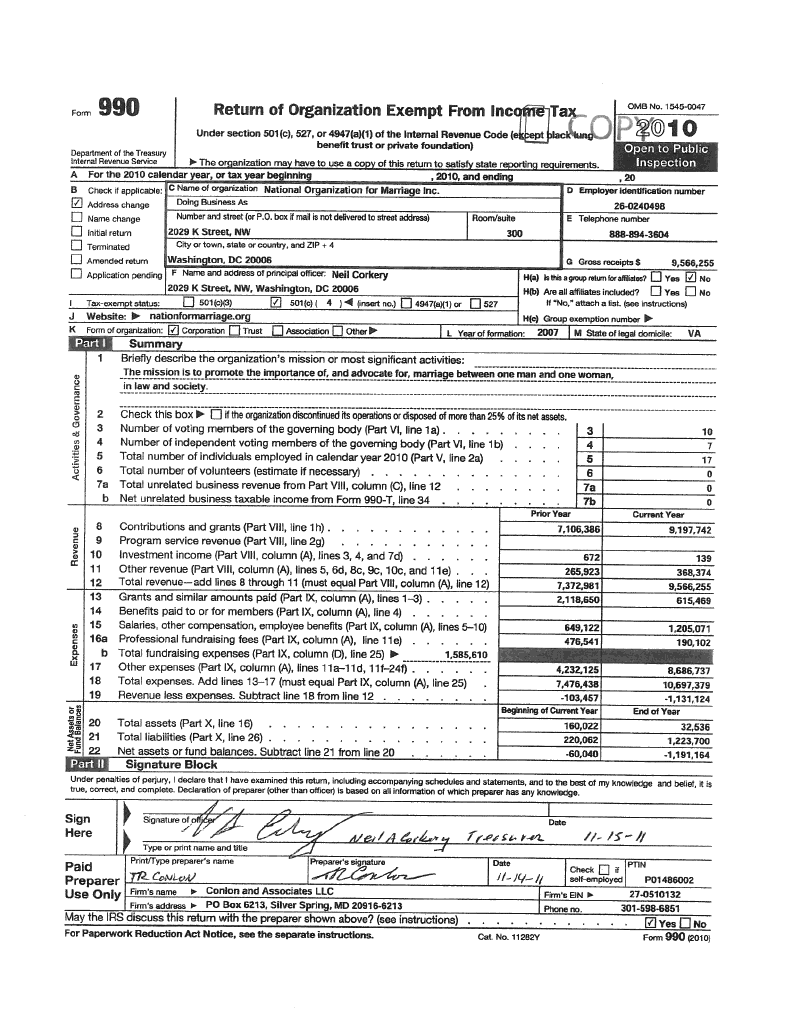

Free state and local tax refund worksheet, Download Free state

State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. Use this worksheet to determine the taxable portion of your prior year state refund. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. Enter amounts from your previous year.

Free state and local tax refund worksheet, Download Free state

If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. Use this worksheet to determine the taxable portion of your prior year state refund. Enter amounts from your previous year return and the. I'm receiving 4 different errors related to state tax refund.

State Tax Refund Worksheet Schedule 1 Line 1

State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. Do i need to complete the state refund worksheet? I'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: If you did not itemize. If you received a refund for.

State And Local Tax Refund Worksheet

Do i need to complete the state refund worksheet? State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. I'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: If you received a refund for your 2023 state tax return,.

State Refund Taxable Worksheet Tax State Refund Taxab

Use this worksheet to determine the taxable portion of your prior year state refund. State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you.

Tax Worksheet 2023

If you received a refund for your 2023 state tax return, a portion of that refund needs to be allocated to the payment you made in the. I'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: Do i need to complete the state refund worksheet? @reneevyne the state tax refund worksheet,.

State Tax Refund Worksheet Item Q Line 1 Printable Word Searches

Do i need to complete the state refund worksheet? Use this worksheet to determine the taxable portion of your prior year state refund. If you did not itemize. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. If you received a refund for your 2023 state tax return, a portion of.

State And Local Tax Refund Worksheet 2019

Enter amounts from your previous year return and the. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. If you did not itemize. Use this worksheet to determine the taxable portion of your prior year state refund. If you received a refund for your 2023 state tax return, a portion of.

State And Local Tax Refund Worksheet State Tax

Use this worksheet to determine the taxable portion of your prior year state refund. If you did not itemize. @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. State and local income tax refund worksheet—schedule 1, line 10 be sure you have read the exception in the instructions for this. Do.

State And Local Income Tax Refund Worksheet—Schedule 1, Line 10 Be Sure You Have Read The Exception In The Instructions For This.

I'm receiving 4 different errors related to state tax refund worksheet, what's the correct items to enter for: @reneevyne the state tax refund worksheet, item q, line 1, is for property tax from your 2019 return. Use this worksheet to determine the taxable portion of your prior year state refund. Do i need to complete the state refund worksheet?

If You Received A Refund For Your 2023 State Tax Return, A Portion Of That Refund Needs To Be Allocated To The Payment You Made In The.

If you did not itemize. Enter amounts from your previous year return and the.