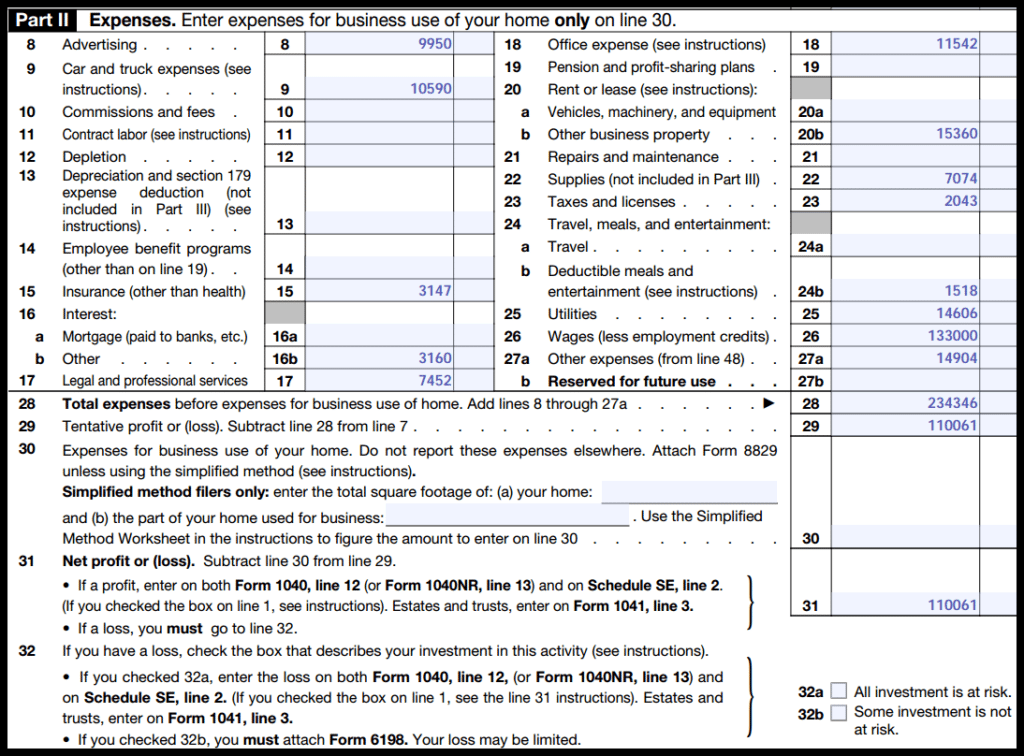

Schedule C Worksheet Amount Misc Exp Other Must Be Entered - Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c.

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other” expenses. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c.

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Taxpayers can deduct these as “other” expenses.

Printable Schedule C Worksheet

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other”.

Schedule C Expenses Worksheet 2022

You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the.

Schedule C Worksheet Misc Exp Other

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. Taxpayers can deduct these as “other” expenses. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a.

What Is A Schedule C Worksheet

Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule.

Schedule C Worksheet Amount Misc Exp Other

Taxpayers can deduct these as “other” expenses. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the.

Schedule C Worksheet Amount Misc Exp Other

A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other”.

20++ Schedule C Worksheet Worksheets Decoomo

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. Taxpayers can deduct these as “other” expenses. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule.

Schedule C Worksheet Amount Misc Exp Other

You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Taxpayers can deduct these as “other” expenses. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the.

What Is A Schedule C Worksheet

Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the review. Taxpayers can deduct these as “other” expenses. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule.

What Is A Schedule C Worksheet

A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. Taxpayers can deduct these as “other” expenses. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Try reviewing your expenses in the miscellaneous section in the turbotax wizard (not the schedule c they provide during the.

Try Reviewing Your Expenses In The Miscellaneous Section In The Turbotax Wizard (Not The Schedule C They Provide During The Review.

A breakdown of “other” expenses must be listed on line 48 of form 1040 schedule c. You have a other miscellaneous expense description entered in your business section of turbotax without a corresponding. Taxpayers can deduct these as “other” expenses.

:max_bytes(150000):strip_icc()/ScheduleC-ProfitorLossfromBusiness-1-2b9fe42e669342c783bbaae69e570415.png)