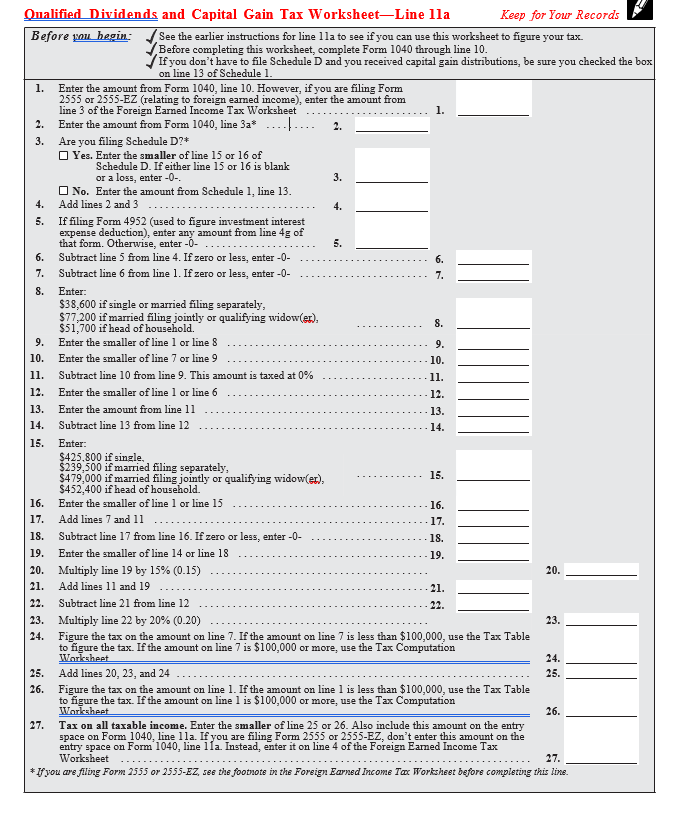

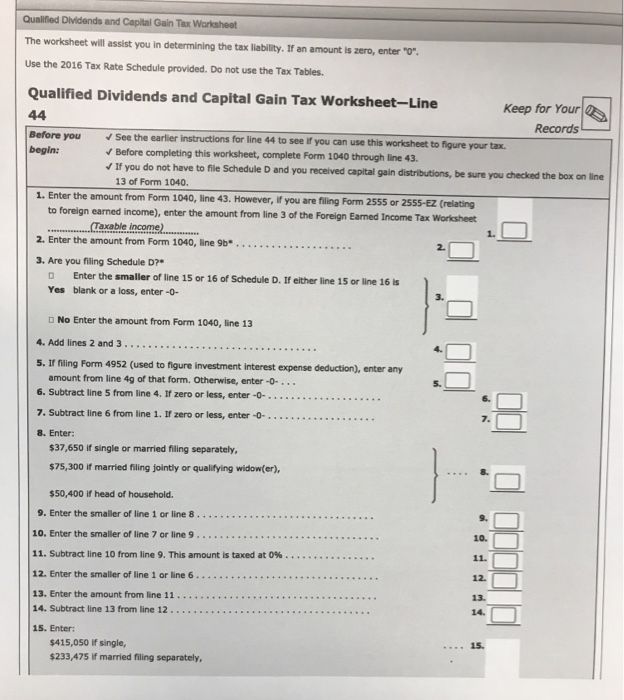

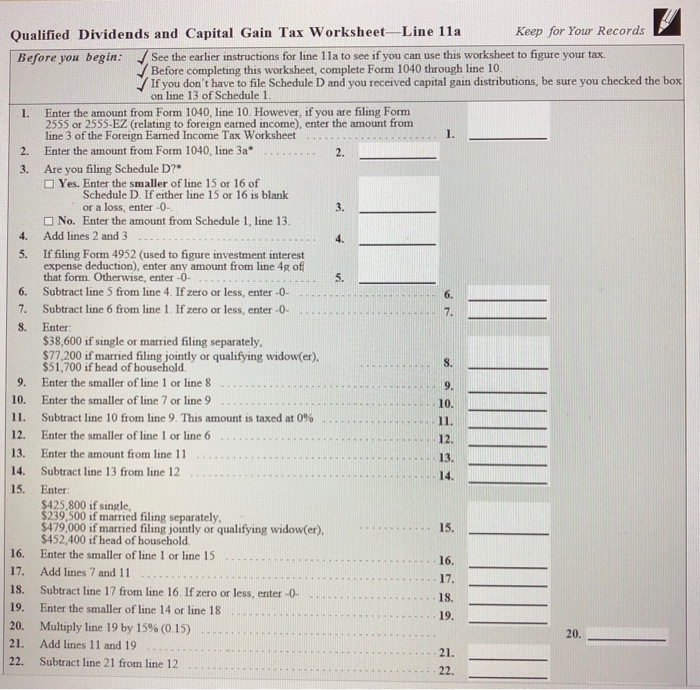

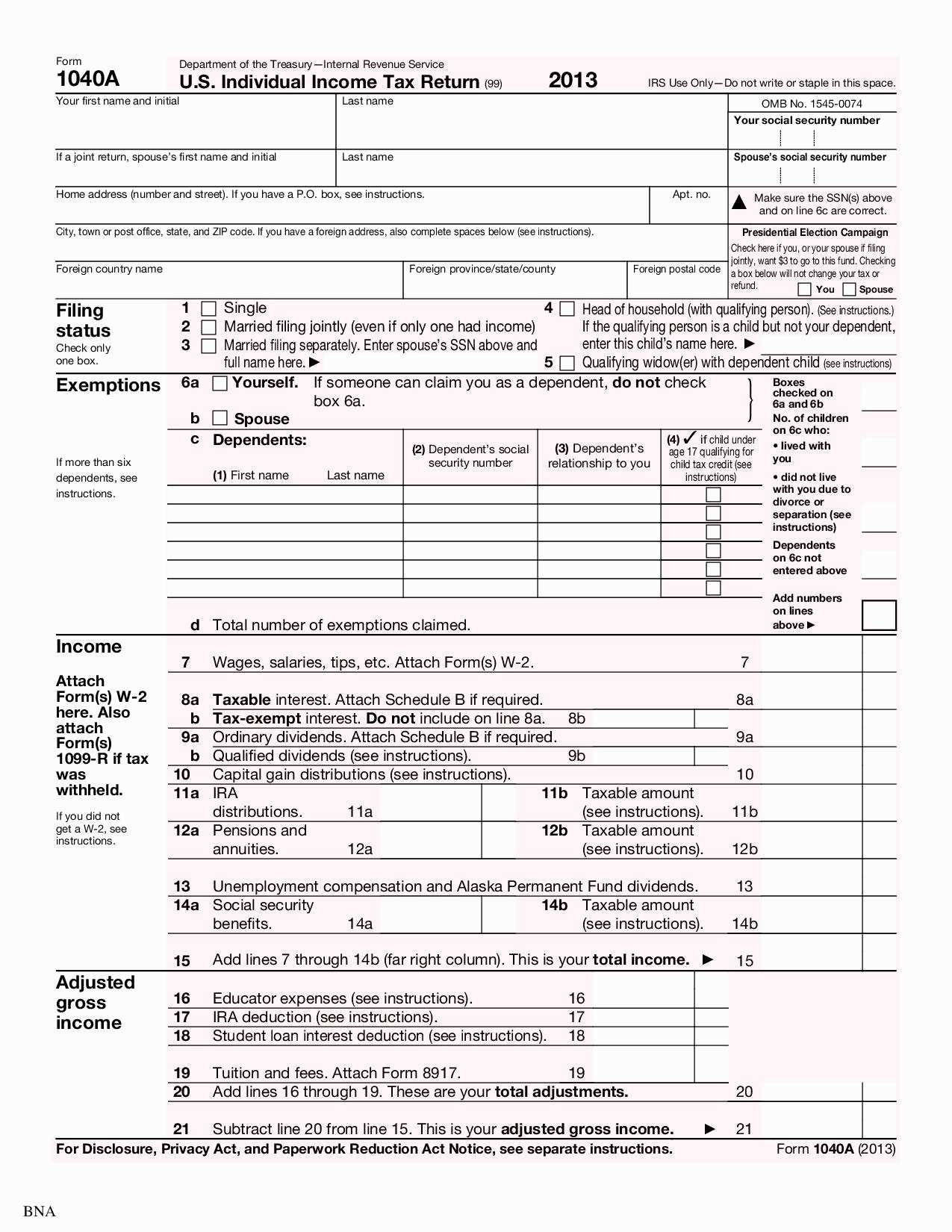

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2021 - When the irs processes your return, if you fit those circumstances, it will check. Before completing this worksheet, complete form 1040 through line 10. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Dividends are generally taxed at your ordinary income tax rates. Use the qualified dividends and capital gain tax worksheet to figure your tax if. If you don’t have to file.

Use 1 of the following methods to calculate the tax for line 16 of form 1040. When the irs processes your return, if you fit those circumstances, it will check. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Dividends are generally taxed at your ordinary income tax rates. Use the qualified dividends and capital gain tax worksheet to figure your tax if. If you don’t have to file. Before completing this worksheet, complete form 1040 through line 10.

When the irs processes your return, if you fit those circumstances, it will check. If you don’t have to file. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Use the qualified dividends and capital gain tax worksheet to figure your tax if. Dividends are generally taxed at your ordinary income tax rates. Before completing this worksheet, complete form 1040 through line 10. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?.

Qualified Dividends And Capital Gain Tax Worksheetline 16

When the irs processes your return, if you fit those circumstances, it will check. Use the qualified dividends and capital gain tax worksheet to figure your tax if. Dividends are generally taxed at your ordinary income tax rates. If you don’t have to file. Use 1 of the following methods to calculate the tax for line 16 of form 1040.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Dividends are generally taxed at your ordinary income tax rates. Before completing this worksheet, complete form 1040 through line 10. If you don’t have to file. When the irs processes your return, if you fit those circumstances, it will check.

Qualified Dividends And Capital Gains Tax Worksheet 2022 Qua

Before completing this worksheet, complete form 1040 through line 10. If you don’t have to file. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Dividends are generally taxed at your ordinary income tax rates. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?.

Qualified Dividends And Capital Gain Tax Worksheet Calculato

If you don’t have to file. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Use the qualified dividends and capital gain tax worksheet to figure your tax if. Before completing this worksheet, complete form 1040 through line 10. Dividends are generally taxed at your ordinary income tax rates.

1040 Qualified Dividends And Capital Gain Tax Worksheet Prin

Use 1 of the following methods to calculate the tax for line 16 of form 1040. When the irs processes your return, if you fit those circumstances, it will check. Before completing this worksheet, complete form 1040 through line 10. Dividends are generally taxed at your ordinary income tax rates. Did you dispose of any investment(s) in a qualified opportunity.

Qualified Dividends And Capital Gain Tax Worksheet For 2021

Use the qualified dividends and capital gain tax worksheet to figure your tax if. Before completing this worksheet, complete form 1040 through line 10. When the irs processes your return, if you fit those circumstances, it will check. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Dividends are generally taxed at your ordinary.

Qualified Dividends And Capital Gain Tax Worksheet 2023 Qual

If you don’t have to file. Use the qualified dividends and capital gain tax worksheet to figure your tax if. Before completing this worksheet, complete form 1040 through line 10. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Dividends are generally taxed at your ordinary income tax rates.

Qualified Dividends And Capital Gain Tax Irs

Dividends are generally taxed at your ordinary income tax rates. Use the qualified dividends and capital gain tax worksheet to figure your tax if. When the irs processes your return, if you fit those circumstances, it will check. Use 1 of the following methods to calculate the tax for line 16 of form 1040. If you don’t have to file.

Capital Gains And Dividends Worksheet Printable And Enjoyable Learning

Use 1 of the following methods to calculate the tax for line 16 of form 1040. Before completing this worksheet, complete form 1040 through line 10. When the irs processes your return, if you fit those circumstances, it will check. Did you dispose of any investment(s) in a qualified opportunity fund during the tax year?. Dividends are generally taxed at.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

Use 1 of the following methods to calculate the tax for line 16 of form 1040. If you don’t have to file. When the irs processes your return, if you fit those circumstances, it will check. Before completing this worksheet, complete form 1040 through line 10. Dividends are generally taxed at your ordinary income tax rates.

Before Completing This Worksheet, Complete Form 1040 Through Line 10.

Dividends are generally taxed at your ordinary income tax rates. If you don’t have to file. Use the qualified dividends and capital gain tax worksheet to figure your tax if. When the irs processes your return, if you fit those circumstances, it will check.

Did You Dispose Of Any Investment(S) In A Qualified Opportunity Fund During The Tax Year?.

Use 1 of the following methods to calculate the tax for line 16 of form 1040.