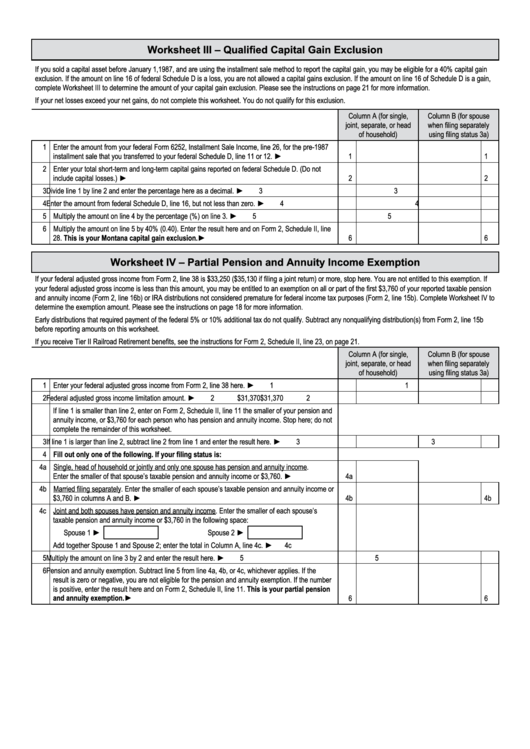

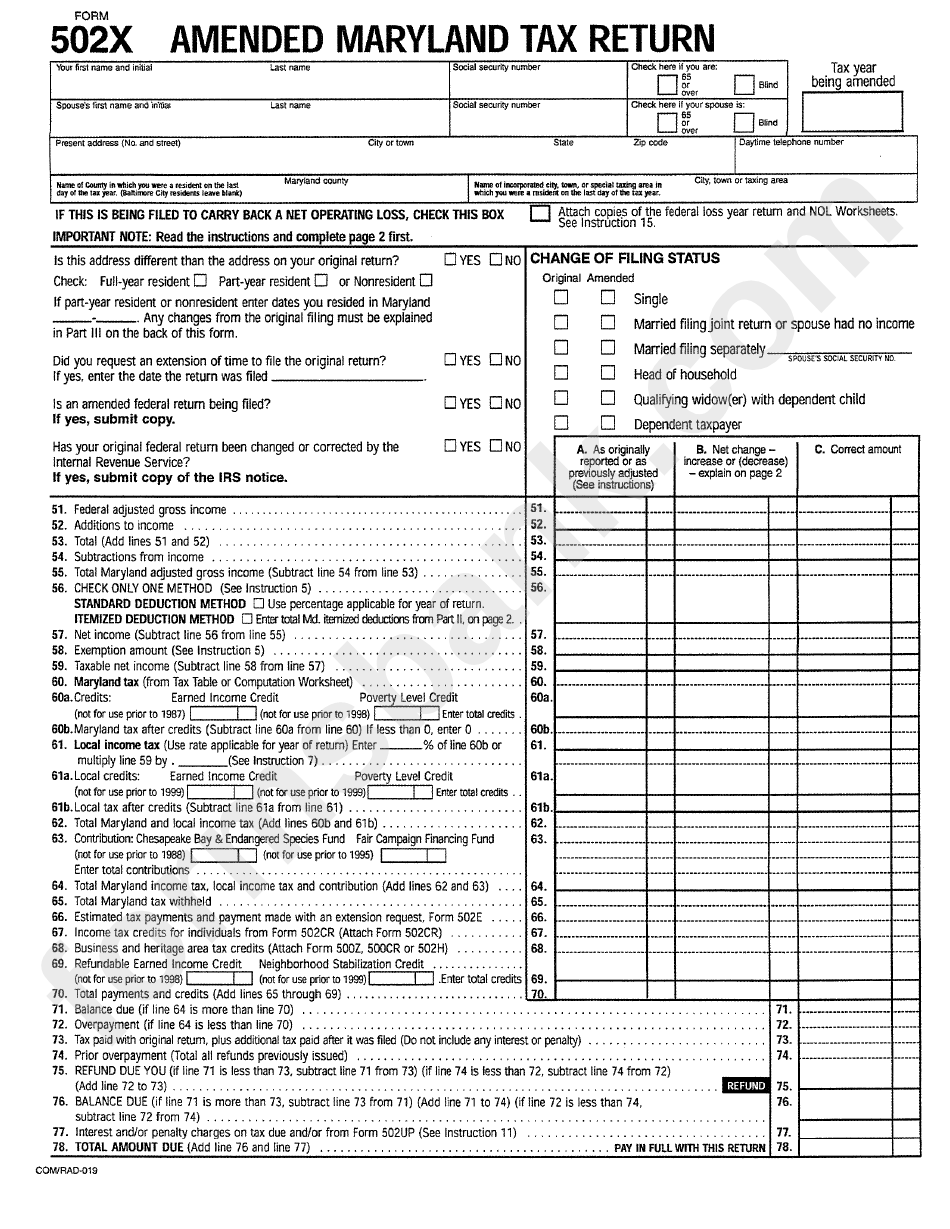

Maryland Pension Exclusion Worksheet - If you are filing jointly, make. Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the. Pension exclusion computation worksheet (13a) specific instructions note: From your $30,000 pension, you can. When both you and your spouse qualify for the pension. Your social security benefits are not taxed. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your.

From your $30,000 pension, you can. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. If you are filing jointly, make. Pension exclusion computation worksheet (13a) specific instructions note: Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. Your social security benefits are not taxed. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the.

If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. Pension exclusion computation worksheet (13a) specific instructions note: If you are filing jointly, make. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Your social security benefits are not taxed. Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. From your $30,000 pension, you can.

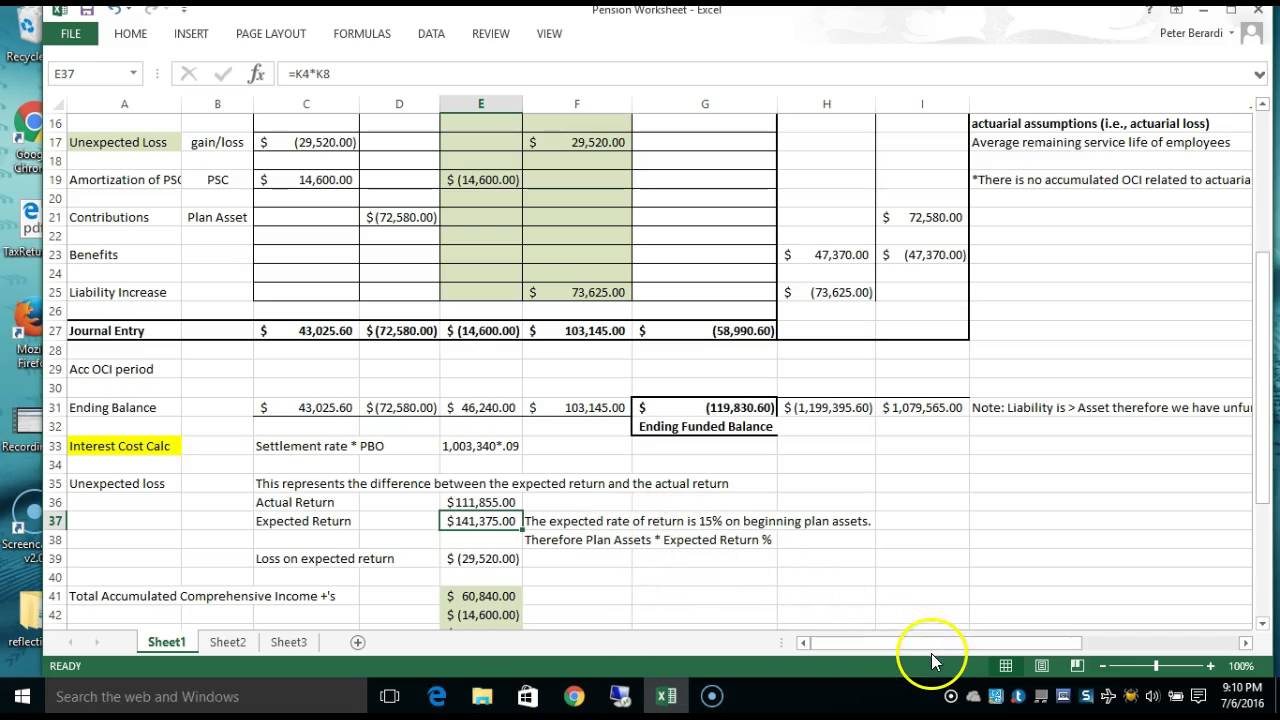

Md Pension Exclusion Worksheet 13a

If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. Pension exclusion computation worksheet (13a) specific instructions note: Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. Enter your net taxable pension and retirement annuity included.

Maryland 2024 Pension Exclusion Amount

If you are filing jointly, make. When both you and your spouse qualify for the pension. From your $30,000 pension, you can. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which.

What Is The Maryland Pension Exclusion

Pension exclusion computation worksheet (13a) specific instructions note: Your social security benefits are not taxed. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a.

Maryland Pension Exclusion Worksheet Printable And Enjoyable Learning

Your social security benefits are not taxed. From your $30,000 pension, you can. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. If you are filing.

Maryland Pension Exclusion 2024

Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have. From your $30,000 pension, you can. Pension exclusion computation worksheet (13a) specific instructions.

Maryland Pension Exclusion 2024

Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the. Your social security benefits are not taxed. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. From your $30,000 pension, you can..

Maryland Pension Exclusion 2024 Pdf

When both you and your spouse qualify for the pension. From your $30,000 pension, you can. If you are filing jointly, make. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the. Your social security benefits are not taxed.

Maryland Pension Exclusion 2024 Pdf

If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6.

Maryland Pension Exclusion Worksheet 13a

If you are filing jointly, make. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Pension exclusion computation worksheet (13a) specific instructions note: If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled,.

Maryland Pension Exclusion 2023 Formula

Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. If social security, tier i, tier ii, and/or supplemental railroad retirement benefits are included in your federal adjusted gross income,. When both you and your spouse qualify for the pension. From your $30,000 pension, you can. If you are 65.

If Social Security, Tier I, Tier Ii, And/Or Supplemental Railroad Retirement Benefits Are Included In Your Federal Adjusted Gross Income,.

Enter your net taxable pension and retirement annuity included in your federal adjusted gross income which is attributable to your. Maryland requires that the $36,200 be reduced by the amount of your 2023 social security benefits. From your $30,000 pension, you can. If you are 65 or older on the last day of the calendar year, you are totally disabled, or your spouse is totally disabled, and you have.

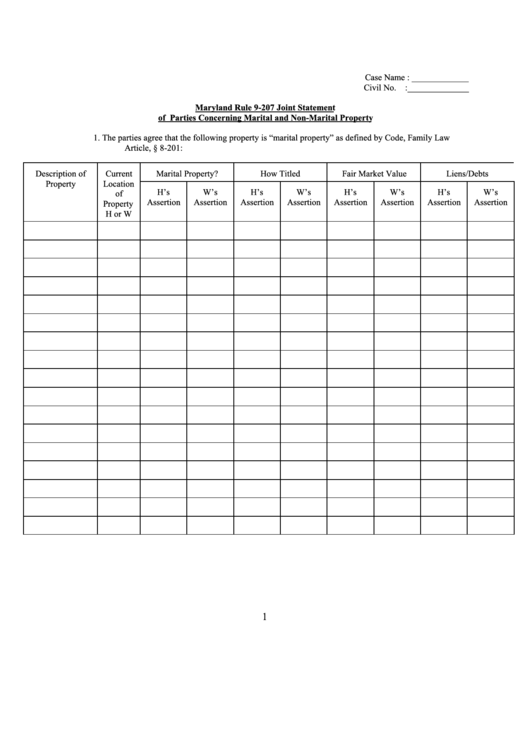

When Both You And Your Spouse Qualify For The Pension.

If you are filing jointly, make. If you are 65 or older or totally disabled (or your spouse is totally disabled), you may qualify for maryland's maximum pension. Pension exclusion computation worksheet (13a) specific instructions note: Part 6 if you claimed a pension exclusion on line 10a of maryland form 502, complete part 6 using information from worksheet 13a of the.