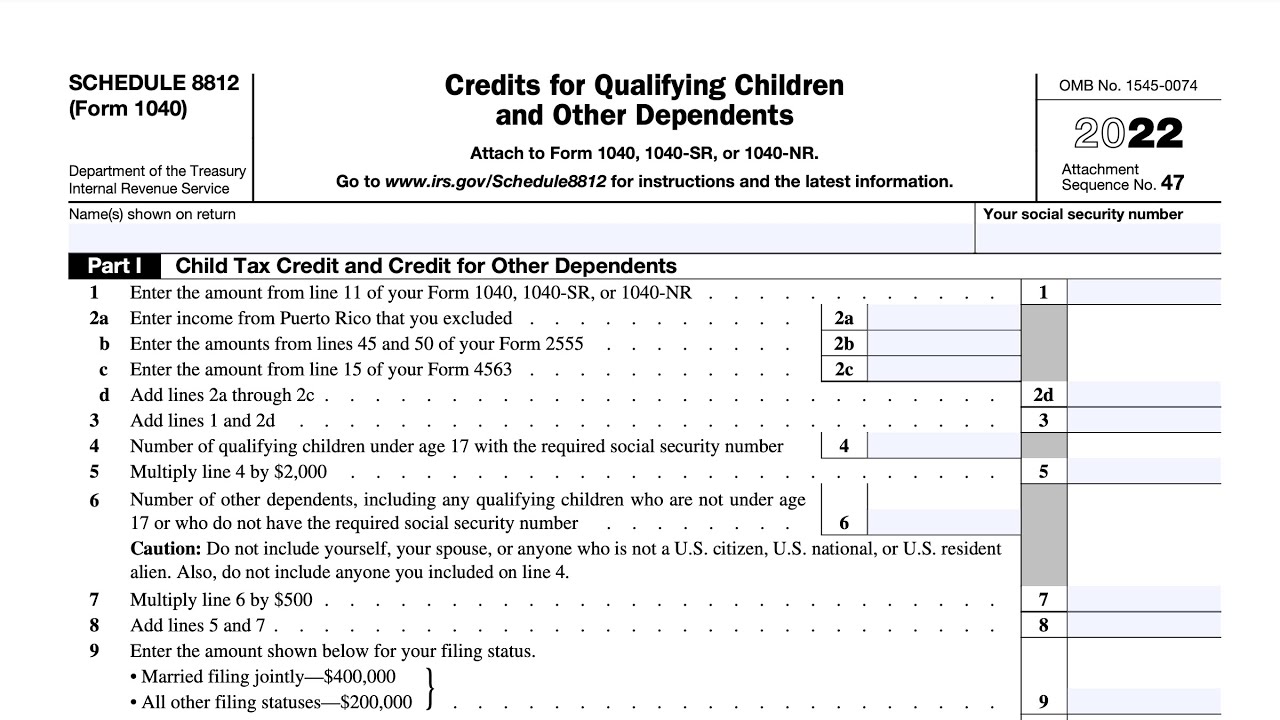

Credit Limit Worksheet 2021 - For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enhanced credits for children under age 6 and under age 18 expired. $3,600 for children ages 5 and under at the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. The maximum credit can be up to $2,000 for each qualifying.

Enhanced credits for children under age 6 and under age 18 expired. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: The maximum credit can be up to $2,000 for each qualifying. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. $3,600 for children ages 5 and under at the.

Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. $3,600 for children ages 5 and under at the. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Enhanced credits for children under age 6 and under age 18 expired. The maximum credit can be up to $2,000 for each qualifying.

Child Tax Credit Limit Worksheet A 2021

$3,600 for children ages 5 and under at the. Enhanced credits for children under age 6 and under age 18 expired. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. The maximum.

Child Tax Credit Limit Worksheet A 2021

For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: The maximum credit can be up to $2,000 for each qualifying. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enhanced credits for children under age 6 and under age.

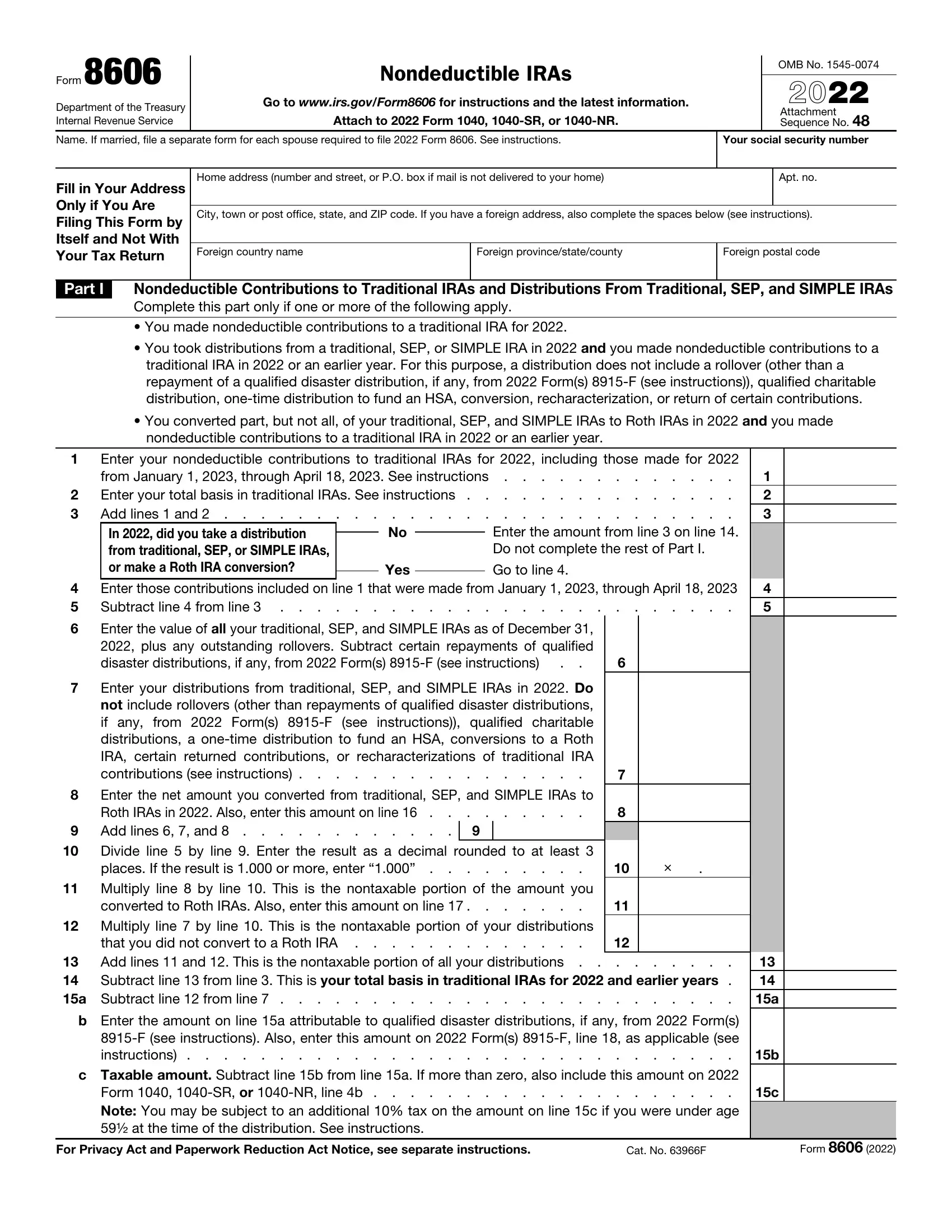

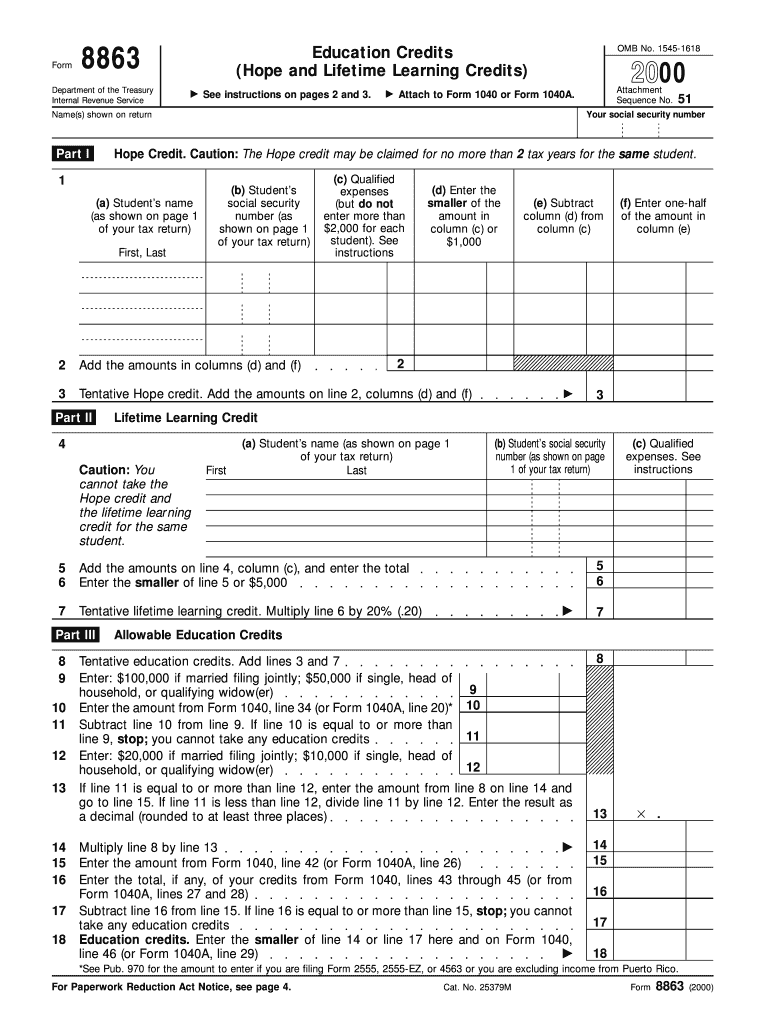

Credit Limit Worksheet 8863

Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Enhanced credits for children under age 6 and under age 18 expired. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. For tax.

Credit Limit Worksheet For Form 2441 Credit Limit Worksheet

Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. Enhanced credits for children under age 6 and under age 18 expired. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. $3,600 for.

Blank 8863 Credit Limit Worksheet Fill Out and Print PDFs

$3,600 for children ages 5 and under at the. The maximum credit can be up to $2,000 for each qualifying. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on.

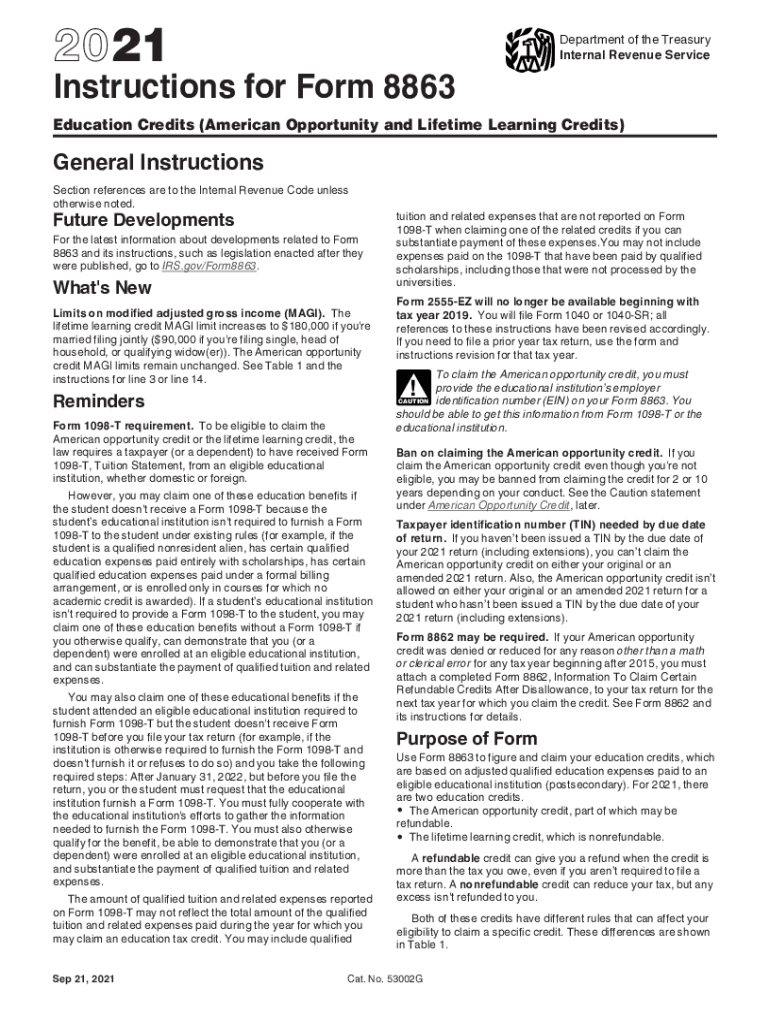

2021 Form IRS Instruction 8863 Fill Online, Printable, Fillable, Blank

The maximum credit can be up to $2,000 for each qualifying. For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. $3,600 for children ages 5 and under at the. Enter.

8863 Credit Limit Worksheet Form 8863education Credits

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. Enhanced credits for children under age 6 and under age 18 expired. The maximum credit can be up to $2,000 for each qualifying. For tax year 2021, the child tax credit increased from $2,000 per qualifying.

IRS Form 8863 📝 Get Federal Tax Form 8863 for 2022 Instructions

Enhanced credits for children under age 6 and under age 18 expired. $3,600 for children ages 5 and under at the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. The maximum credit can be up to $2,000 for each qualifying. For tax year 2021, the child.

Form 8880 Credit Limit Worksheet 2021

Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. The maximum credit can be up to $2,000 for each qualifying. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040), line 3. $3,600 for children.

Irs Credit Limit Worksheet 2021 For Form 8880

For tax year 2021, the child tax credit increased from $2,000 per qualifying child to: Enhanced credits for children under age 6 and under age 18 expired. $3,600 for children ages 5 and under at the. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits..

For Tax Year 2021, The Child Tax Credit Increased From $2,000 Per Qualifying Child To:

The maximum credit can be up to $2,000 for each qualifying. Enhanced credits for children under age 6 and under age 18 expired. Complete the credit limit worksheet b only if you meet all of the following. you are claiming one or more of the following credits. $3,600 for children ages 5 and under at the.